The Best and Worst States to Start a Small Business

Where are America’s best states to start a small business? A major factor to consider when determining the best state to start a business in is the cost associated with doing business there. There is a wide range of business expenses for entrepreneurs to consider, and the state you start your business in can greatly affect those costs. High business startup costs can lead to higher rates of failure within the first few years, as business owners end up with lower profits and decide that their business is no longer sustainable.

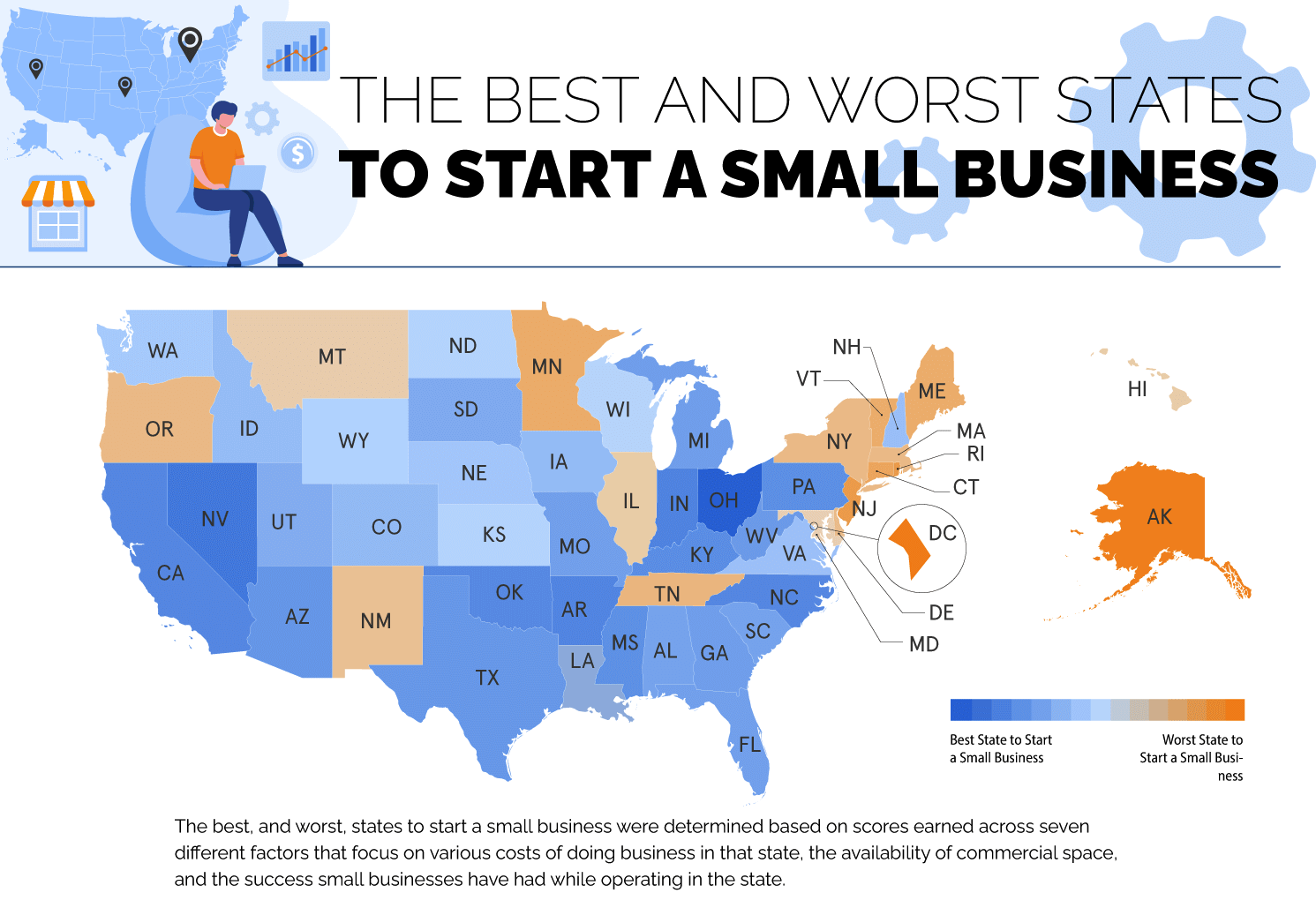

At Finfare, we are committed to helping small businesses succeed. To support this goal, we created a Small Business Index to determine which U.S. states are the best and worst for starting a small business. The best, and worst, states to start a small business were determined based on scores earned across seven different factors that focus on various costs of doing business in that state, the availability of commercial space, and the success small businesses have had while operating in the state. Check out the index below to see which we found to be the most business-friendly states.

What is the Best State to Start a Small Business?

Ohio is the best state to start a small business, based on the results of our small business index. The Buckeye State earned the highest index score thanks to the state’s lower business costs. Ohio does not have a corporate tax, and the low wage base allows business owners in Ohio to spend less on state unemployment taxes.

Small businesses in Ohio that earn less than $385,000 per year can pay their employees a minimum wage of $7.25 per hour, while businesses that earn above the $385,000 threshold abide by a minimum wage of $10.45 per hour. The lower commercial electric bills and LLC fees also allow entrepreneurs in Ohio to spend less on business expenses.

The 10 Best States to Start a Small Business In

- Ohio

- Nevada

- Indiana

- Arkansas

- North Carolina

- California

- Oklahoma

- Kentucky

- Pennsylvania

- Mississippi

What is the Worst State to Start a Small Business?

The District of Columbia is the worst state to start a business in the United States. It earned the lowest score on our Small Business Index due to the much higher costs that business owners incur there compared to the other states. The average commercial electric bill in D.C. is outrageously high at $3,492 per month, nearly tripling the next highest average.

Employee wages are another high cost for business owners in D.C. with the highest minimum wage in the U.S. at $17 an hour. When you consider the corporate tax rate of 8.3% and the higher LLC fees, small businesses in D.C. can face higher expenses than in most other states.

The 10 Worst States to Start a Small Business In

- District of Columbia

- Alaska

- New Jersey

- Rhode Island

- Connecticut

- Minnesota

- Maine

- Vermont

- Tennessee

- Oregon

What State Has the Lowest Minimum Wage?

Nearly half of the states have either not adopted a state minimum wage, or it falls below $7.25 so the federal minimum wage of $7.25 applies instead. The twenty states with a minimum wage of $7.25 include Alabama, Georgia, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Mississippi, New Hampshire, North Carolina, North Dakota, Oklahoma, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Wisconsin, and Wyoming.

Lower employee expenses are certainly a plus for small businesses that are just getting started and looking to lower business costs, but we do believe that people should be paid fairly and recommend paying above minimum wage to entice better employees to want to work for you and help your business succeed.

What State Has the Highest Minimum Wage?

The District of Columbia has the highest minimum wage in America at $17 per hour. The rate applies through July 1, 2024, after which it will increase to $17.50 per hour. Washington’s minimum wage is $16.28 per hour, making it the second-highest minimum wage in the nation.

The 5 States With the Highest Minimum Wage

- District of Columbia: $17

- Washington: $16.28

- California: $16

- Connecticut: $15.69

- New York: $15 ($16 for NYC, Long Island, and Westchester)

Small business owners can’t escape the many expenses involved with running a business, so why not turn those expenses into opportunities with the Finfare Executive Charge Card!? Our all-in-one platform saves you time by tracking, managing, and reconciling your business expenses; and it also saves you money with rewards and deals tailored for your business. Come see why we’re the card small businesses can trust!

THE SMALL BUSINESS INDEX: The Best States to Start a Small Business

All 50 States (and Washington D.C.) in order of Finfare.com’s Small Business Index score:

- Ohio – 596.8

- Nevada – 568.8

- Indiana – 556.1

- Arkansas – 554.5

- North Carolina – 552.4

- California – 552.0

- Oklahoma – 549.8

- Kentucky – 545.5

- Pennsylvania – 544.6

- Mississippi – 543.1

- Arizona – 536.5

- Texas – 535.0

- West Virginia – 531.8

- Georgia – 527.8

- Michigan – 527.3

- Missouri – 526.1

- Florida – 525.8

- South Carolina – 523.1

- Alabama – 522.9

- South Dakota – 515.7

- Utah – 511.6

- Colorado – 500.5

- Iowa – 498.7

- Idaho – 497.7

- New Hampshire – 494.3

- Virginia – 492.2

- Louisiana – 490.6

- Nebraska – 486.8

- Washington – 484.0

- Wyoming – 477.2

- North Dakota – 474.3

- Kansas – 474.2

- Wisconsin – 470.8

- Maryland – 461.5

- Montana – 457.2

- Hawaii – 454.6

- Illinois – 453.7

- New Mexico – 441.9

- Delaware – 437.3

- Massachusetts – 433.6

- New York – 433.4

- Oregon – 433.0

- Tennessee – 428.5

- Vermont – 417.4

- Maine – 416.5

- Minnesota – 414.2

- Connecticut – 406.8

- Rhode Island – 393.6

- New Jersey – 393.5

- Alaska – 352.0

- District of Columbia – 348.9

STATE CORPORATE TAX

States with the Lowest Corporate Tax Rate

- NV, OH, SD, TX, WA, WY – 0%

- NC – 2.5%

- MO – 4%

- OK – 4%

- ND – 4.3%

States with the Highest Corporate Tax Rate

- NJ – 11.5%

- MN – 9.8%

- IL – 9.5%

- AK – 9.4%

- PA – 9%

STATE UNEMPLOYMENT TAX

States With Lowest Wage Base for Unemployment Tax

- AR, CA, FL, TN – $7,000

- LA – $7,700

- AL, AZ, VA – $8,000

- MD – $8,500

- DC, NE, OH, TX, WV – $9,000

States With Lowest Wage Base for Unemployment Tax

- HI – $59,100

- ID – $53,500

- OR – $52,800

- AK – $49,700

LLC FEE

States With the Lowest LLC Fees

- NM, MO, MS, MI, IA, HI, CO, AR, AZ – $50

- KY – $55

- MT – $70

- UT – $72

- NV & CA – $75

States With the Highest LLC Fee

- MA – $520

- IL – $500

- TN – $325

- TX – $310

- AK – $250

COMMERCIAL ELECTRIC BILL

States With the Lowest Average Monthly Commercial Electric Bill

- MT – $390

- ID – $394

- WV – $422

- NE – $446

- IA – $447

States With the Highest Average Monthly Commercial Electric Bill

- DC – $3,492

- HI – $1,580

- VA – $1,261

- CA – $1,174

- CT – $1,153

MINIMUM WAGE

States With the Lowest Minimum Wage

- AL, GA, ID, IN, IA, KS, KY, LA, MS, NH, NC, ND, OK, PA, SC, TN, TX, UT, WI, WY – $7.25

- OH – $7.25 ($10.45 if making $385k+)

- WV – $8.75

- MN – $8.85 (small employers), $10.85 (large employers)

- MT – $10.30

States With the Highest Minimum Wage

- DC – $17

- WA – $16.28

- CA – $16

- CT – $15.69

- NY – $15 ($16 for NYC, Long Island, and Westchester)

COMMERCIAL SPACES FOR LEASE

States With the Most Commercial Properties and Spaces for Lease per 100k

- Texas – 144

- Hawaii – 142

- California – 134

- Nevada – 131

- Illinois – 126

States With the Least Commercial Properties and Spaces for Lease per 100k

- South Dakota – 20

- Vermont – 27

- Wyoming – 28

- Alaska – 30

- Mississippi – 31

BUSINESS SURVIVAL RATE

1 Year:

States With the Highest Business Survival Rate Within 1 Year

- CA – 86.8%

- WA – 83.3%

- NV – 81.5%

- MA – 81%

- AL – 80.5%

States With the Lowest Business Survival Rate Within 1 Year

- DC – 72%

- MO – 72.8%

- RI – 72.8%

- MT – 73.9%

- VT – 74.5%

5 Years:

States With the Highest Business Survival Rate Within 5 Years

- OR – 58.40%

- SD – 55.70%

- CA – 55.20%

- MS – 55.20%

- MA &WV – 55.00%

States With the Lowest Business Survival Rate Within 5 Years

- MO – 39.5%

- DC – 44.2%

- DE – 45%

- ME – 46.2%

- RI – 46.4%

-

Notes:

- Corporate Tax Rate and Business Survival Rate scores were determined to be the most important factors and were weighted heavier. With the small differences between LLC fees, the scores were given less weight so as to have less influence on the final score.

- Commercial spaces for lease data was not available for Colorado, Delaware, or Oregon so each state earned a mid–range score.

- State Unemployment Tax index scores were based on each state’s wage base. The employer only pays unemployment taxes up until the point the employee has earned the wage base.